In the fast-paced world we live in, accessing funds quickly and efficiently is a necessity for many people. Whether it’s for emergency expenses, starting a new business, or managing debt, personal loans or online lending services have become a common solution. These loans not only provide immediate relief but also offer flexibility and convenience for everyday financial needs. With the rise of technology, personal loans have evolved, making the process of borrowing easier, faster, and more accessible.

What Is a Personal Loan?

A personal loan is a type of unsecured loan, which means it doesn’t require collateral or a guarantor. The approval for such loans is based on an applicant’s financial profile, including income, credit history, and their ability to repay the loan. These loans can be used for a wide range of purposes, from urgent medical expenses to funding a business or consolidating existing debt. One of the key advantages of personal loans is their versatility: they are typically not tied to a specific purchase or expenditure, giving the borrower freedom in how the funds are used.

The Flexibility of Personal Loans

Personal loans are designed to cater to a variety of financial needs. Some of the most common uses for personal loans include:

- Emergency Expenses: Life is unpredictable, and unexpected situations such as medical emergencies or urgent repairs can arise without warning. Personal loans can provide quick access to the funds needed to cover these expenses.

- Business Investments: If you’ve always wanted to start a business or expand an existing one, a personal loan could provide the necessary capital. For example, if you’re starting a small business like an online store, a personal loan can help you purchase inventory or invest in marketing efforts.

- Debt Consolidation: Personal loans can also be used to consolidate multiple debts into one manageable monthly payment. This is particularly useful for individuals with high-interest credit card debt or loans, as the interest rate on a personal loan is usually lower than credit card rates.

The beauty of personal loans is their adaptability. Borrowers can use the loan for almost any purpose without the restrictions that often accompany other types of loans, such as auto or home loans, which are tied to the purchase of a specific asset.

Personal Loans or Instant Loans: Modern Financial Innovations

Gone are the days when applying for a loan meant long hours spent in a bank’s lobby, filling out paperwork and waiting for approval. The advent of online lending has completely transformed the loan application process, making it faster, simpler, and more accessible. Online loans, also known as instant loans, can be applied for via mobile apps or websites, allowing borrowers to access funds in minutes.

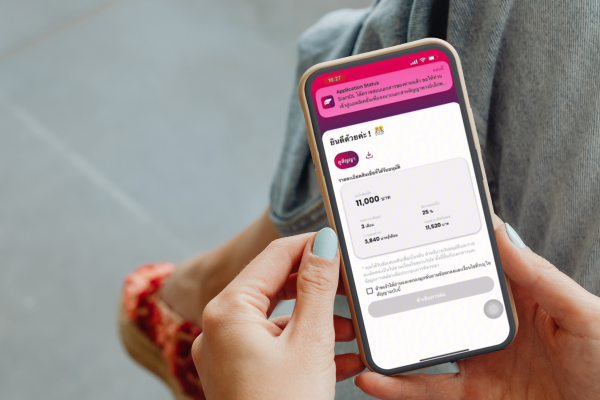

One of the key innovations in this area is digital lending. Digital lending platforms like Siam Digital Lending offer a streamlined process for applying for a loan without the need for physical paperwork or visits to a bank branch. By simply using a smartphone, borrowers can apply for a loan, submit documents, and receive approval in a fraction of the time it would traditionally take at a bank.

The Advantages of Personal Loans or Online Borrowing

- Convenience

One of the greatest advantages of online lending is the convenience it offers. Gone are the days of needing to visit a bank or credit institution in person. Online loan services allow you to apply for a loan at your convenience, from anywhere, at any time. Whether you’re at home, at work, or on the go, you can easily access your loan application via a mobile app.

- Speed

In the past, the loan approval process could take days or even weeks. Online loans have significantly sped up this process. For example, services like Siam Digital Lending can approve loans and transfer funds in as little as 15 minutes, which is ideal for those needing immediate financial assistance.

- Security

Despite being a digital service, many online loan providers, including Siam Digital Lending, are regulated by the Bank of Thailand. This ensures that they adhere to strict standards of fairness, transparency, and data protection. Your personal information is safeguarded, and you can rest assured that the loan is legitimate and compliant with local laws.

- Accessibility

Unlike traditional loans, online lending can be accessed from almost anywhere, as long as you have a smartphone and an internet connection. This makes personal loans more accessible to individuals living in remote areas or those who may have limited access to physical bank branches.

Tips for Choosing the Right Personal Loan

When looking for the ideal personal loan, it’s essential to compare options from various providers. Here are a few important factors to consider:

- Interest Rates

The interest rate is one of the most critical elements to consider when taking out a loan. A lower interest rate means you’ll pay less in the long term. Be sure to compare interest rates from different loan providers to ensure you’re getting the best deal.

- Repayment Terms

Different lenders offer varying repayment terms. It’s essential to choose a loan with repayment terms that fit your financial situation. Make sure you understand the monthly repayment amount and the total duration of the loan.

- Provider Credibility

Always choose a loan provider with a solid reputation and regulatory oversight. Opting for a licensed lender, like Siam Digital Lending, ensures that you’re working with a legitimate institution that follows legal guidelines and offers fair lending practices.

Real-Life Applications of Personal Loans

- Emergency Situations

Take, for example, Mr. Somchai, who faced a sudden medical emergency and needed to pay for surgery immediately. Rather than worrying about how to gather the funds, he applied for a personal loan through the Siam Digital Lending app. Within 15 minutes, the funds were approved and transferred directly to his bank account, allowing him to pay for the surgery and focus on recovery.

- Starting a Small Business

Ms. Somying had always dreamed of opening her own online clothing store. However, she lacked the capital needed to purchase inventory and equipment. Rather than waiting for months to save money, she opted for a personal loan from Siam Digital Lending. Within minutes, she had the funds she needed to kickstart her business, and she repaid the loan using her store’s profits.

Siam Digital Lending: A Safe and Reliable Choice

When looking for a fast, reliable, and secure online personal loan, Siam Digital Lending stands out as an excellent option. Not only does it offer a simple application process, but it also guarantees a fast approval process, often disbursing funds in as little as 15 minutes. With no collateral required and transparent interest rates, Siam Digital Lending is a trustworthy and user-friendly option for personal loans.

Key Features of Siam Digital Lending:

- Easy online application through a mobile app

- No collateral or guarantor needed

- Transparent interest rates with no hidden fees

- Secure platform regulated by the Bank of Thailand

How to Apply for a Siam Digital Lending Personal Loan

The application process for a Siam Digital Lending loan is straightforward. All you need is a smartphone and the app installed. Follow these steps:

- Download the App: Get the Siam Digital Lending app from the Google Play Store or the Apple App Store.

- Apply for a Loan: Complete the application form, upload required documents, and submit the application.

- Receive Approval: The loan will be approved within 15 minutes.

- Get Funded: Funds will be transferred directly to your bank account, ready to use.

Download Now!

Why Choose Siam Digital Lending?

Siam Digital Lending offers a range of features that make it a top choice for personal loans:

- Unsecured Loans: No need for collateral or a guarantor.

- Loan Amount: Borrow up to 5 times your average monthly income, or up to 200,000 THB.

- Flexible Repayment Terms: Repay the loan over a period of up to 30 months.

- Instant Approval: Get results in just 15 minutes.

- 100% Online Process: Apply, receive funds, check balances, and pay bills all through the app.

- Legal and Secure: Regulated by the Bank of Thailand for your safety and security.

Contact Us

Siam Digital Lending Co., Ltd. is committed to providing tailored financial solutions to help individuals access safe and legal loans. By adhering to the Bank of Thailand’s guidelines, Siam Digital Lending is helping to reduce informal lending and household debt.

Address: 8th Floor, Dr. Gerhard Link Building, 5 Soi Krungthep Kritha 7, Hua Mak, Bang Kapi, Bangkok 10240

Phone: 02-016-9300 (Business Hours: 08:30–17:30)

Email: [email protected]

By embracing technology, Siam Digital Lending has made personal loans more accessible, efficient, and transparent. The entire loan process, from application to funding, is designed to be seamless and stress-free. If you need quick, reliable financial support, Siam Digital Lending is here to help.

Download the app today and experience a faster, safer, and more convenient way to manage your finances!