Start the new year with strong financial liquidity! After working hard to earn income throughout the past year, it’s time to embrace the new year with expenses that bring joy—whether it’s celebrating with family, hosting a special event, or renovating your home to make it better than ever. To make your spending easier, more convenient, and faster, we’d like to introduce the hot new personal loan of 2024-2025. With easy online applications, you can borrow up to five times your average monthly income, starting from a minimum income of 12,000 THB. This is the legal online loan app from SiamDL.

Update! Current Personal Loan Application Trends… Introducing SiamDL, The Legal Online Loan App, Trending in 2024-2025.

Current Personal Loan Application Trends

In today’s world, applying for loans has become much more convenient and accessible, as financial institutions and lending companies have adapted to consumer behavior focused on digital technology. Online personal loans have become the primary option, reducing the time and hassle of the process.

- Popularity of Legal Online Loans

With the development of apps and online platforms, applicants can apply through their mobile phones or computers, eliminating the need to visit bank branches. The advantage is the quick decision-making process, especially for personal loans that require minimal documentation. - Strict Approval Processes

Although applying for loans has become easier, financial institutions are still becoming more stringent in evaluating applicants’ qualifications, including checking credit reports, debt repayment capacity, and regular income.

เงินก้อนทันใจ - The Importance of Legal Loans

Nowadays, there has been an increase in unauthorized loan providers not regulated by authorities. It is crucial to apply for loans from reliable sources, such as banks or licensed companies, to avoid unfair interest rates and potential legal issues.

- Trends in Low-Interest Personal Loans

In a recovering economy, low-interest personal loans have become popular as they help ease the burden of high interest for borrowers. These loans often come with special conditions for those with good credit or stable income.

- Loan Education

Many organizations now focus on educating consumers about loans to help them make informed decisions. This includes providing information about interest rates, repayment periods, and hidden fees.

The trend in loan applications today is centered around convenience, speed, and security. Borrowers should carefully check their information and qualifications, as well as choose legal and trustworthy lenders, to ensure a smooth borrowing process and meet their financial needs effectively.

The Difference Between Applying for Loans in the Past and Present

The loan application process has evolved significantly from the past to the present, due to advancements in technology, changes in consumer behavior, and adaptations by financial institutions. The key differences are as follows:

- Application Process

- In the Past:

To apply for a loan, individuals had to visit a bank or financial institution in person, bringing all necessary documents. The process was time-consuming, as it involved manually filling out forms and waiting for offline approval. - Today:

Applications can be completed online through apps or websites of loan providers. There is no need to visit a branch, and documents can be uploaded digitally immediately.

- In the Past:

- Approval Time

- In the Past:

The approval process could take several days or even weeks due to manual verification and approval procedures. - Today:

AI and digital technologies have sped up the approval process. Some loans can be approved in just a few hours or within the same day.

- In the Past:

- Required Documents

- In the Past:

Applicants had to prepare numerous documents, such as their ID card, house registration, salary certificate, and various certified copies from relevant authorities. - Today:

The required documentation has been greatly reduced. Some loans only require basic documents like an ID card, payslip, or bank statements, which can be uploaded online.

เจ้าของกิจการ

- In the Past:

- Access to Services

- In the Past:

Loan applications were mostly limited to banks and large financial institutions, making it difficult for people in rural areas or those without a credit history to access loans. - Today:

There are numerous loan services available through private companies and digital platforms. Consumers in remote areas can now apply conveniently via mobile devices.

- In the Past:

- Interest Rates and Terms

- In the Past:

Interest rates were typically higher due to the lack of market competition, and terms were often less flexible. - Today:

Interest rates have lowered due to increased competition. Providers offer promotions and terms that suit various needs, such as low-interest personal loans.

- In the Past:

- Knowledge and Understanding of Applicants

- In the Past:

Borrowers often had limited knowledge about loans and may not have compared personal loan offers or providers. - Today:

Consumers have more information available through the internet and comparison platforms, allowing for more informed decision-making.

- In the Past:

As seen, applying for loans today is much more convenient, fast, and accessible through digital systems, unlike the past, which involved complicated processes and long waiting times. This development meets the demands of consumers seeking flexibility and transparency in their loan applications.

Siam Digital Lending : The Legal Online Loan App Trend of 2024-2025

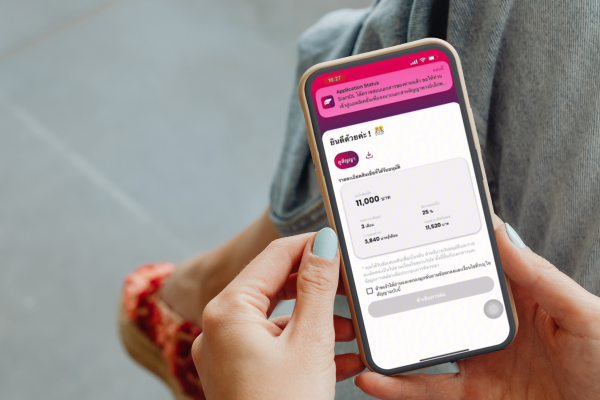

SiamDL’s personal loans are set to be one of the hottest online lending options for 2024-2025. This legal personal loan is an unsecured, multipurpose loan offering up to 5 times the borrower’s average monthly income, with a maximum of 200,000 THB. The funds are transferred in one lump sum and can be repaid in installments (as per the Bank of Thailand’s guidelines).

SiamDL’s personal loans cater to those in need of quick funds, offering a fully digital application process. From application submission to document upload, identity verification, loan approval, and fund disbursement, everything is done online.

SiamDL also provides a full suite of online services, including loan balance checks, bill payments, installment schedules, and 24/7 loan officer consultation, ensuring convenience and accessibility for all borrowers.

Benefits of SiamDL : The Legal Online Loans App, That Will Impress You

- Loan Amount: Up to 50 times your income (minimum 5,000 THB, maximum 200,000 THB)

- For applicants earning less than 30,000 THB, the loan approval will be up to 1.5 times the monthly income.

- For applicants earning more than 30,000 THB, the loan approval will be up to 5 times the monthly income.

- Fulfill all your needs with SiamDL’s multipurpose, unsecured personal loan

No collateral or guarantor required, with repayment options up to 30 months. - Quick loan approval: Get funds fast with approval within 15 minutes.

- Full online service: Apply for the loan, receive funds, check balances, pay bills, and view installment schedules—all online.

- Legally regulated: The loan is fully compliant with the Bank of Thailand and adheres to personal data protection laws under the Personal Data Protection Act (PDPA).

- Transparent service: Offers fair loan terms with an interest rate of 25%, along with financial counseling for debt management.

- Low-income eligibility: Apply with a minimum income starting at 12,000 THB.

How to Apply for SiamDL The Legal Online Loans App ?

Applying for legal loans is easier than you think. You can apply for SiamDL Personal Loans through two convenient online channels:

- Masii Website (https://masii.co.th/thailoan)

- SiamDL Application, available for download on Google Play Store and App Store.

Who Can Apply for SiamDL Online Loans?

Applicants must meet the following criteria:

- Age between 20 and 60 years

- Minimum monthly income of 12,000 Baht

- For employees, at least 6 months of current employment

- Thai nationality

Required Documents for SiamDL Personal Loan Application

Identity verification documents:

- A copy of your ID card (or a copy of a government official ID or a state enterprise employee ID with your ID number and photo, along with a copy of your house registration).

Income verification documents:

- A current payslip or income certificate.

- A bank statement for the last month.

ulfill all your needs with SiamDL Personal Loans, an online, unsecured loan option. No collateral or guarantor required. Get a large lump sum quickly with approval within 15 minutes, and enjoy a loan limit of up to 5 times your average monthly income or a maximum of 200,000 Baht. Choose to repay in installments for up to 30 months. If you have any questions, feel free to contact us at 02 016 9300 or add us on Line @siamdlloan (with the @ symbol).

Apply for SiamDL Personal Loan on Android

Apply for SiamDL Personal Loan on iOS

Call Us!

Read more interesting articles about personal loans:

Read more interesting articles about personal loans:

- Lucky Numbers Based on Birthdays: How to Choose Prosperous Numbers for Wealth and Success

- masii Tips: 10 Social Security Benefits You Should Know About (2023 Update)

- GSB Personal Business Loans: Borrow up to 500,000 THB with a 10-Year Repayment Plan

- 10 Strategies for Effective Saving

- Attention: GH Bank Launches Loan Certificate Downloads via Mobile App!

_____________________________________________

Please become SDL Fan

- Facebook: Siam Digital Lending

- Website: https://siamdl.co.th

- Line: @siamdlloan

- Tel: 02 016 9300

- Youtube: https://lnkd.in/gbQf9eh

- LinkedIn: https://www.linkedin.com/company/siamdigitallending/

- Instagram: https://instagram.com/siam_dl?igshid=YmMyMTA2M2Y=

#SiamDL #SiamDigitalLending #PersonalLoan #QuickLoans #LegalLoanApp

#LoanApp #LowInterestRates #QuickApproval #LoanApp #RepaymentMethods #SiamDL

#Finance #OnlineLoans