Accessing financial services has become easier than ever, regardless of your profession or career path. However, this convenience also comes with potential risks. With the rising demand for financial solutions, both legal and illegal loan options have surged, making it easy to fall victim to illegal money lending. This can lead to serious consequences and ongoing problems. To avoid such pitfalls, SiamDL is here to guide you on how to successfully apply for a personal loan through legitimate banks and financial institutions. We’ll walk you through the essential documents required to ensure a smooth application process. These documents are categorized into two main groups: general applicants and business owners.

Keep reading to learn more about the specific requirements for each group and make your personal loan application stress-free.

Interested in applying for a personal loan? Let’s get started!

The Ultimate Guide to Personal Loan Applications: Proven Strategies for Easy Approval and Must-Have Documents

Applying for Legal Personal Loans: Everything You Need to Know

Personal Loans are a type of financing designed for individuals without requiring a specific purpose. They are ideal for covering expenses, purchasing new items, starting a small business, consolidating debt, or other personal needs.

Typically, personal loans come with fixed repayment terms and predictable interest rates. Loan approval primarily depends on the borrower’s repayment ability and credit history. Unlike secured loans, personal loans don’t require collateral like a house or car. However, borrowers must adhere to the terms outlined in the loan agreement and repay the debt on time.

While most legal personal loans don’t require collateral, preparing the necessary documents in advance can significantly streamline the approval process. Let’s explore the documents required for a personal loan application, categorized into two main groups: general individuals and business owners.

Personal Loans for Salaried Individuals

Salaried individuals refer to those engaged in regular employment but not owning a business, such as corporate employees, office staff, or government officials. Today, SiamDL has compiled the essential documents required to apply for personal loans specifically for this category.

Stay prepared and simplify the loan application process with these guidelines tailored to your needs!

Documents Required for Personal Loan Applications (General Individuals)

General individuals include employees, office staff, company personnel, and government officials. Below is a summary of the necessary documents:

- Copy of ID card or Government Official ID Card

- Copy of Household Registration

- Salary slip (original or copy), Income Certificate, or Proof of Income (original)

- Bank account statements (3–6 months for irregular income earners)

- Copy of the first page of a savings bank account passbook (for transferring approved funds)

Important Notes

- Requirements may vary between financial institutions. For example, some may require only the latest salary slip, while others might request 3–6 months of slips.

- Always verify specific requirements with the institution before applying.

Stay informed and prepared to ensure a smooth and efficient loan application process with SiamDL, your trusted financial partner.

Personal Loan Requirements for Business Owners

Business owners, such as shopkeepers, smoothie vendors, and hardware store owners, may need to apply for a personal loan tailored to their needs. Here’s a detailed guide on the necessary documents required for business owners applying for a personal loan.

Required Documents for Business Owners

- Copy of ID card

- Company certificate or Partnership registration documents

- Certified copy of company registration/trade registration or Memorandum of Association (issued within the last 3 months)

- 6 months of bank statements (either for the business or the borrower)

- List of current shareholders (issued within the last 3 months)

- Copy of the first page of a savings bank account passbook (for transferring approved funds)

Important Notes

- Document requirements may vary across financial institutions. For instance, some may request only the latest income proof, while others might require statements for 3–6 months.

- Verify the specific requirements with the financial institution before submitting your application.

Stay prepared to simplify your loan application process and secure funding for your business smoothly with SiamDL.

While the documents listed by SiamDL cover the general requirements for most financial institutions, it’s crucial to note that individual institutions may have varying additional document needs. Preparing the suggested documents in advance can help streamline the application process before contacting your desired financial institution.

How to Secure a Personal Loan Safely?

Ensuring safety while applying for loans is vital to avoid unmanageable debt burdens. SiamDL shares essential tips to complement your loan application journey:

- Assess Necessity: Carefully evaluate whether you genuinely need a loan and, if so, determine the required amount to avoid over-borrowing.

- Align with Income: Maintain a healthy debt-to-income ratio, borrowing only within a manageable repayment capacity.

- Understand Interest Rates: Research fixed and variable interest rates associated with your chosen loan product.

- Review Costs & Conditions: Read the loan terms thoroughly, considering payment schedules, penalties, and other clauses.

- Borrow from Reliable Sources: Apply through trusted banks or licensed financial institutions to ensure legitimacy.

- Maintain Good Credit: Timely repayments build a positive credit history, improving future loan eligibility.

- Read Contracts Carefully: Fully understand the terms of your loan agreement before signing, and ask questions about unclear points.

- Avoid Misleading Ads: Be cautious of overly enticing online loan offers and assess hidden costs or conditions.

While SiamDL cannot guarantee loan approval, proper preparation and adherence to these guidelines can help you respond promptly to any additional document requests from financial institutions, enhancing your chances of success.

Achieve your financial goals with SiamDL’s versatile personal loans—no collateral required!

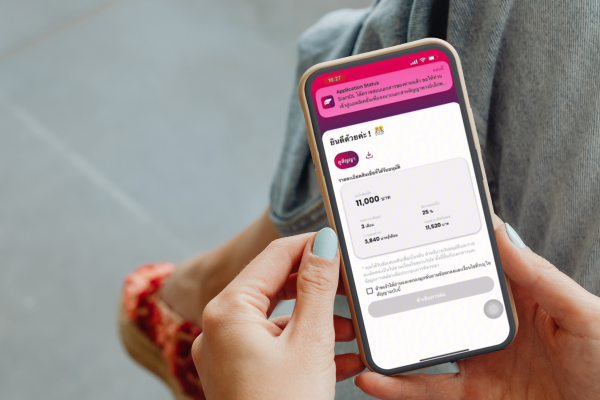

Siam Digital Lending App: Your Trusted Partner for Legal Online Loans

Looking for legal loans through an app? Siam Digital Lending offers an accessible and reliable option without requiring collateral or a guarantor. Enjoy loan amounts up to 5 times your average monthly income, or a maximum of 200,000 THB, with repayment terms of up to 30 months.

Key Features of SiamDL Personal Loans:

- Convenient & Flexible: No collateral or guarantor required, with approval limits of up to 200,000 THB.

- Quick Approval: Get loan approval results in as fast as 15 minutes.

- Fully Online Services: Apply, receive funds, check balances, pay bills, and review repayment schedules—all through the app.

- Legal & Transparent: Governed by the Bank of Thailand, adhering to the Personal Data Protection Act to ensure data security.

- Fair Lending Practices: Transparent terms and fair interest rates capped at 25%, with personalized debt management consultations.

- Accessible for All: Minimum income requirement starts at just 12,000 THB.

Ready to Apply?

Download the Siam Digital Lending app now from Google Play or the App Store and experience seamless and straightforward loan application processes. (Borrow responsibly and repay within your means.)

This is another great option with SiamDL Personal Loan. With a minimum monthly income of 12,000 THB, you can apply for a loan of up to 200,000 THB or 5 times your income, and enjoy repayment terms of up to 30 months. The application process is simple and free via the app. Submit your documents and receive approval results quickly (within 15 minutes at the fastest).

For those looking for financial support to meet their needs, consider SiamDL Personal Loan. If you have any questions, feel free to call us at 02 016 9300 or add us on Line at @siamdlloan (don’t forget the @)

Apply for SiamDL Personal Loan on Android

Apply for SiamDL Personal Loan on iOS

Call Us!

Explore more interesting articles!

- Pay Water & Electricity Bills – Get Cash Loans Legally

- 7 Digital Savings Accounts with High Interest Rates in 2024

- 6 Tips for Easy Loan Application Success

- Why Fuel Prices in Thailand Aren’t Dropping According to Global Market Trends

- What Online Sellers Need to Know About Taxes

- List of Banks and Financial Institutions Cutting Loan Interest Rates by 0.25% for 6 Months

Please become SDL Fan

- Facebook: Siam Digital Lending

- Website: https://siamdl.co.th

- Line: @siamdlloan

- Tel: 02 016 9300

- Youtube: https://lnkd.in/gbQf9eh

- LinkedIn: https://www.linkedin.com/company/siamdigitallending/

- Instagram: https://instagram.com/siam_dl?igshid=YmMyMTA2M2Y=

#SiamDL #SiamDigitalLending #PersonalLoan #QuickLoans #LegalLoanApp

#LoanApp #LowInterestRates #QuickApproval #LoanApp #RepaymentMethods #SiamDL

#Finance #OnlineLoans