Money matters are undeniably one of the most significant challenges in today’s world. Whether it’s daily expenses or unforeseen emergencies, having access to funds when needed can make all the difference. Waiting for money from your income or other sources may often be too slow to meet urgent needs. This is where personal loan come in as a practical financial tool that can help without disrupting your lifestyle.

However, securing a personal loan is not always straightforward. Inadequate preparation, missing documents, or failing to meet eligibility criteria can result in delays or even rejection. That’s why today, we’ll explore how to prepare effectively for a personal loan application. What documents are required? What steps should you take to increase your chances of approval?

Don’t wait—apply for your personal loan today!

Personal Loan Made Simple: What Documents Do You Need? Quick & Easy Guide!

What is a Personal Loan?

A Personal Loan is a type of unsecured borrowing from banks or financial institutions that does not require collateral or guarantors. It’s designed for personal use without restrictions on its purpose. Personal loans are commonly used to cover general expenses such as paying off debts or credit card bills, funding education, making large purchases, traveling, or handling emergencies like medical treatments or home repairs.

Personal loans typically have predefined interest rates and repayment terms. Borrowers must make monthly payments as scheduled until the debt is fully paid off. The application process usually involves an evaluation to determine the maximum loan amount, interest rate, and repayment duration.

Summary of Required Documents for Personal Loan Applications

- Copy of ID Card or Government Officer ID Card

- Copy of House Registration

- Salary Slip (original or copy) or Employment/Income Certificate (original)

- Bank Statement (last 3–6 months) for applicants with irregular income.

- Copy of the First Page of a Savings Bank Account Book (for fund transfer purposes).

Note: Some financial institutions may have specific requirements, such as requesting only the latest salary slip or slips from the past 3–6 months. Always double-check the details before applying.

Example of Documents Needed for Personal Loan Applications from Financial Institutions

Legal Online Loan by Siam Digital Lending

SiamDL Personal Loan Service

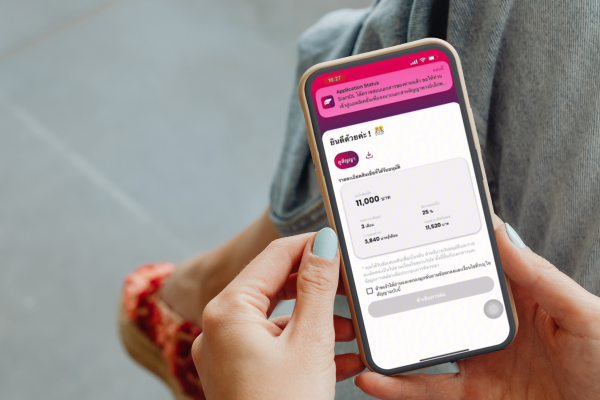

The SiamDL Personal Loan from Siam Digital Lending Co., Ltd. offers an easy application process through a legal lending app. No collateral or guarantor is required, and approved applicants receive cash directly into their bank accounts. Borrow up to 5 times your monthly income with repayment terms of up to 30 months for convenience.

Loan Amount: Approval is based on SiamDL’s evaluation criteria, offering up to 5 times the average monthly income, in accordance with Bank of Thailand regulations.

Loan Term: Repayment periods range from 3 to 30 months.

Interest Rate and Fees: Interest rates are capped at a maximum of 25% per year.

Interest and Fee Calculation: Calculated on a reducing balance basis according to the approved loan amount and chosen repayment period.

Eligibility Criteria for Personal Loan Applicants

- Age: 20–60 years old

- Minimum Income: THB 12,000 per month

- Employment Tenure: At least 6 months for salaried employees

- Citizenship: Must be Thai

Required Documents for Personal Loan Applications

Identity Verification

- A copy of your Thai ID card (or government official or state enterprise ID card) showing your ID number and photo.

- A copy of your house registration.

Income Verification

- Latest salary slip or income certificate.

- Bank statement for the previous month.

Fulfill All Your Financial Needs with SiamDL Unsecured Personal Loans

SiamDL offers multipurpose personal loans without requiring collateral or guarantors. Borrow up to 5 times your monthly income or a maximum of THB 200,000, with repayment terms of up to 30 months.

Key Features:

- Quick Approval: Receive a decision in as fast as 15 minutes.

- Fully Online Process: Apply, receive funds, check balances, pay bills, and view repayment schedules—all online.

- Legal and Secure: Compliant with Bank of Thailand regulations and the Personal Data Protection Act.

- Transparent Services: Fair lending with a capped interest rate of 25% per year and debt counseling services available.

- Accessible for Low Income: Minimum income requirement starts at THB 12,000 per month.

SiamDL is an excellent option for those earning a minimum monthly salary of THB 12,000, with a maximum loan amount of THB 200,000 or 5 times your income. Enjoy flexible repayment terms of up to 30 months. Apply easily through the app with no fees—just submit the required documents to get approval, possibly within 15 minutes. For inquiries or additional details, call 02-016-9300 or add us on Line at @siamdlloan (don’t forget the @)

Apply for SiamDL Personal Loan on Android

Apply for SiamDL Personal Loan on iOS

Call Us!

Read more interesting articles about personal loans:

Read more interesting articles about personal loans:

- 50 Hilarious Money-Borrowing and Debt-Collecting Captions – Or Skip the Wait and Apply for a Personal Loan Now!

- masii Reveals: How to Calculate Loan Interest – Annual, Monthly, or Daily?

- Dreaming of Money? Accurate Dream Interpretations and Tips to Boost Your Luck – Or Make It Real by Applying for a Legal Personal Loan with masii!

- Facial Features of Success: The Perfect Look for Wealth and Prosperity – Or Grab Instant Cash with a Reliable Cash Card Application!

- Freelancer Loans: Where to Find Personal Loans for Independent Professionals – Apply for Legal, Fast-Approved Cash Loans with masii.

_____________________________________________

Please become SDL Fan

- Facebook: Siam Digital Lending

- Website: https://siamdl.co.th

- Line: @siamdlloan

- Tel: 02 016 9300

- Youtube: https://lnkd.in/gbQf9eh

- LinkedIn: https://www.linkedin.com/company/siamdigitallending/

- Instagram: https://instagram.com/siam_dl?igshid=YmMyMTA2M2Y=

#SiamDL #SiamDigitalLending #PersonalLoan #QuickLoans #LegalLoanApp

#LoanApp #LowInterestRates #QuickApproval #LoanApp #RepaymentMethods #SiamDL

#Finance #OnlineLoans