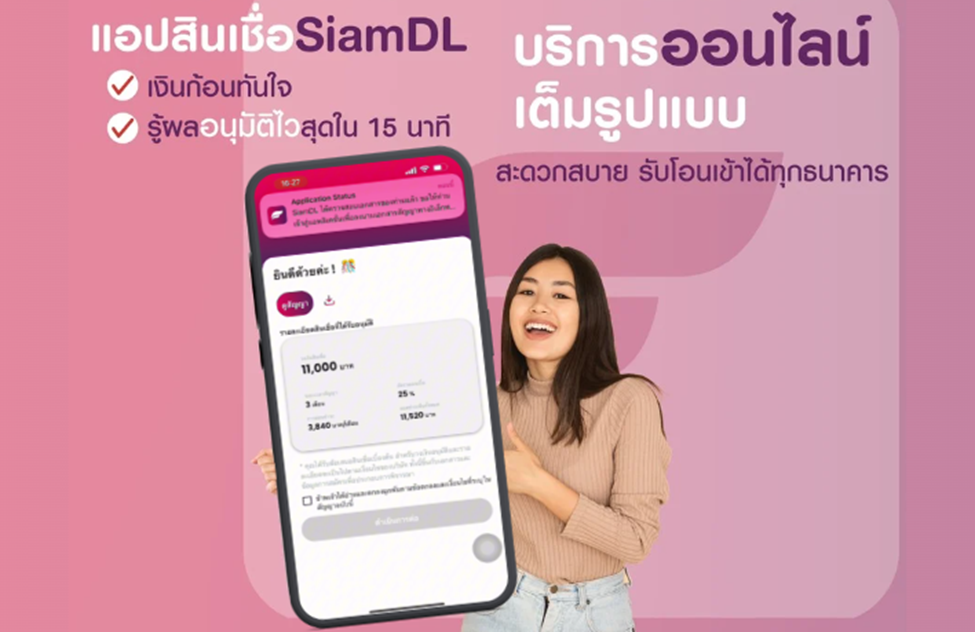

Access to fast and reliable sources of funds is very important and Siam Digital Lending Co., Ltd., as a socially responsible financial service provider under the supervision of the Bank of Thailand, would like to introduce “SiamDL Personal Loan”, which is available on “Siam Digital Lending Application”, a legal loan application that is convenient, safe, and accessible nationwide. It is where you can apply for a personal loan and get approved in just 15 minutes. This article will introduce you to the steps of using the app from downloading to applying for a loan, so that you can access funds quickly and confidently.

Whether you need emergency relief or to plan for the future, legal loan apps like Siam Digital Lending provide the simplicity and assurance you require. A straightforward application procedure with adjustable payback options, fair interest rates, and legal compliance; from registration to identification verification, every step is fully consistent with Thai financial laws. Here’s how to apply for a loan using our app.

How to Apply for a Personal Loan on the Legal Lending App Siam Digital Lending – A Detailed Application Guide

For the legal loan app Siam Digital Lending, we are committed to developing to provide excellent financial services so that users can be confident that they will receive services that meet their needs and comply with the law. The key highlights of SiamDL personal loans are:

- We have a fast approval process. Get loan approval within 15 minutes because the processing and operation of your loan application process will be fully digital and link the data verification base with the National Credit Bureau Co., Ltd. (NCB) and National Digital ID Co., Ltd. (NDID) online.

- We have flexible repayment terms. Choose a repayment period from 3 to 30 months with a fair interest rate that complies with Thai law, giving users peace of mind.

- Legal and compliant because it is licensed and under the supervision of the Bank of Thailand.

“ Now that you’ve seen this, are you ready to sign up? Download the Siam Digital Lending app today and start taking steps towards your financial peace of mind! ”

How to download the Siam Digital Lending app

It’s so easy!!! You can download the legal loan app Siam Digital Lending application today on both Android and iOS smartphones so that you can easily access your funding sources anytime, anywhere. Just follow these simple steps to download the app and start using financial services immediately.

Siam Digital Lending Application Download Steps

- Go to the App Store or Google Play and search for “Siam Digital Lending” in the search box.

- Press Download Application to add the app to your device.

- Install the app by pressing Install after the application download is complete.

- After the installation is complete, press to open the application to start the registration and activation.

… With just a few steps, you are close to applying for a legal loan from a legal loan app, a trusted financial institution. …

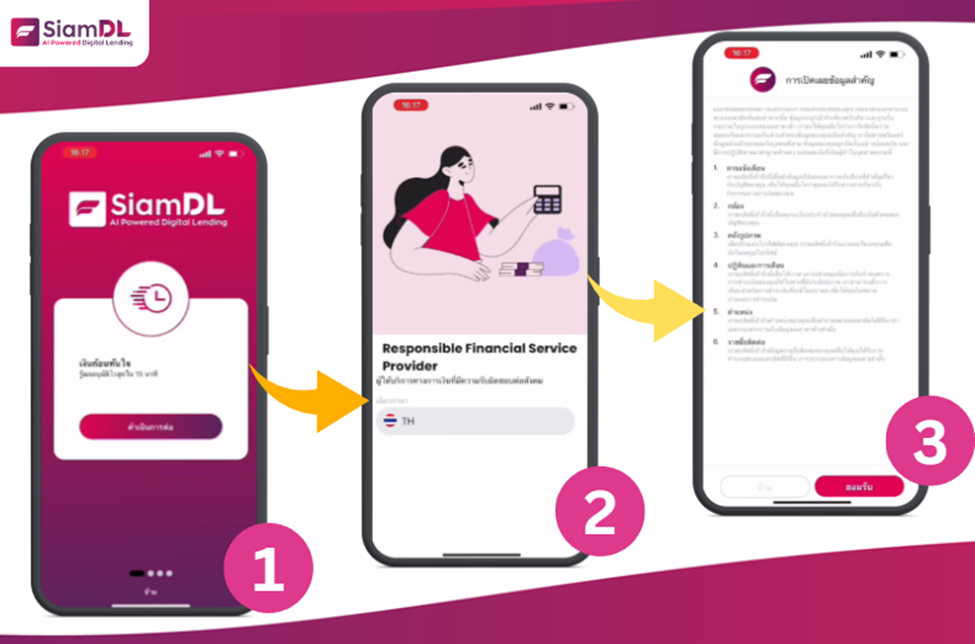

How to register to start using the Siam Digital Lending app

To access SiamDL personal loan services, you must first register through the Siam Digital Lending app. This is a secure registration process that complies with Thailand’s Personal Data Protection Act B.E. 2562 (PDPA), ensuring that your data is protected at all times through tight standards.

Registration Procedure

- Once downloaded, press to activate the application. The system will take the user to the home page where you will find reasons why you should choose us! As a legal loan app, instant cash, approval in 15 minutes, which provides full digital services under the supervision of the Bank of Thailand, along with transparent services. Then press “Continue”.

- The application will then take you to the language selection page (Thai and English).

- Then go to the page asking for permission to open personal information / important information that is necessary, including access to the camera and photo gallery, calendar and reminders, access to contacts and opening notifications (press “Accept the terms of use”. The user must read carefully and accept the terms of use for safe use).

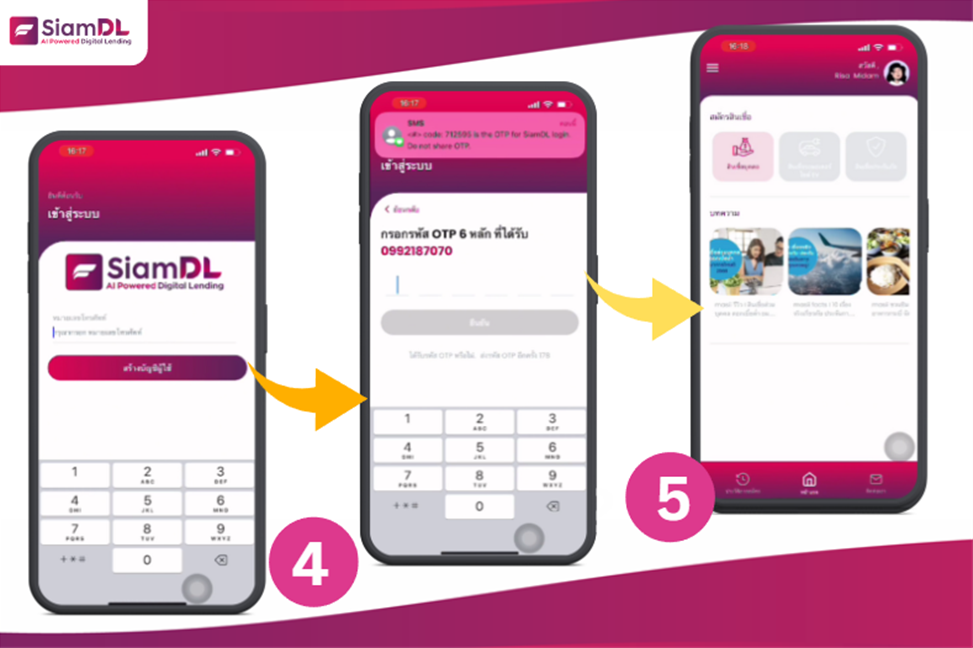

4. Then log in by creating an account by entering your phone number and verifying your user with a 6-digit OTP code sent to your smartphone via SMS.

4. Then log in by creating an account by entering your phone number and verifying your user with a 6-digit OTP code sent to your smartphone via SMS.

5. After that, the application will take you to the first page of the SiamDL personal loan application. This page also has a feature of financial knowledge articles and interesting articles to choose from.

… This registration process takes only a few minutes and you will be ready to apply for a SiamDL personal loan in just a few minutes …

Once registered, you are now ready to apply for a SiamDL personal loan using the fastest legal loan app!! Because our method is easy and adheres to the Bank of Thailand’s legal guidelines, you can safely apply for a loan.

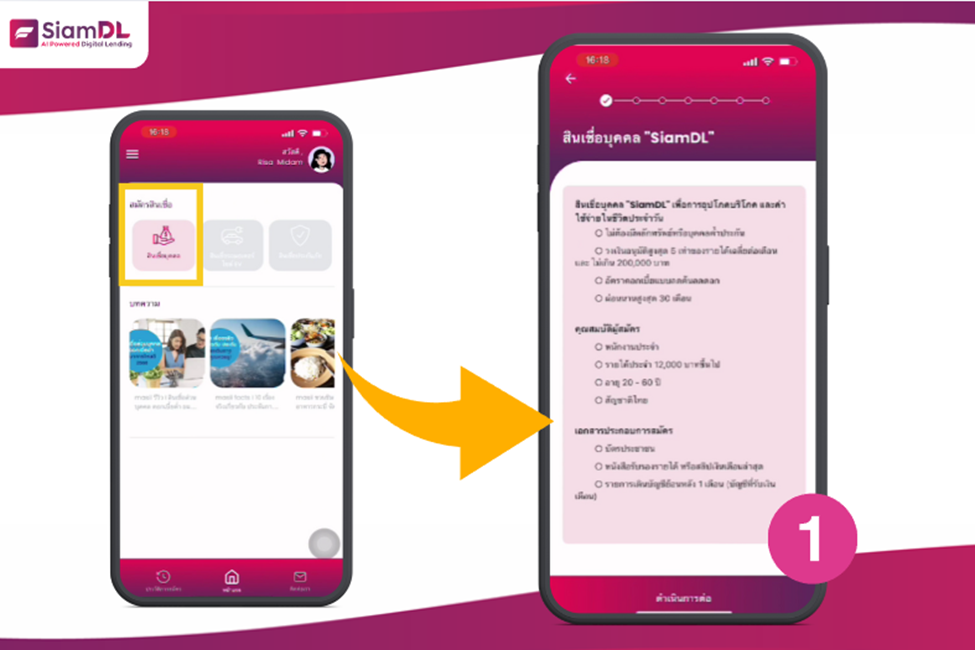

SiamDL Personal Loan Application Process

- When you press the main menu “Apply for a loan”, the application window will take you to the first step, which is the page explaining the loan information, applicant qualifications and application documents.

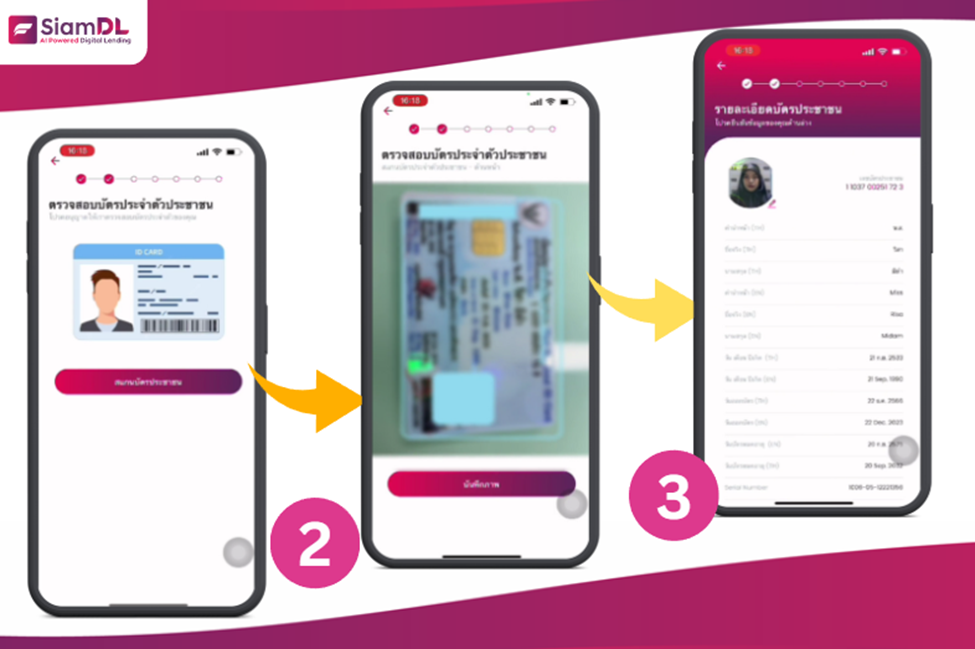

2. Then go to the ID card verification page, press “Scan front and back of ID card”. In this step, the user must not exit the application.

2. Then go to the ID card verification page, press “Scan front and back of ID card”. In this step, the user must not exit the application.

3. Once the ID card scan is completed, the application will take you to the Check ID Card Details page. On this page, the user must verify the accuracy and add current information before pressing “Confirm Data Accuracy”.

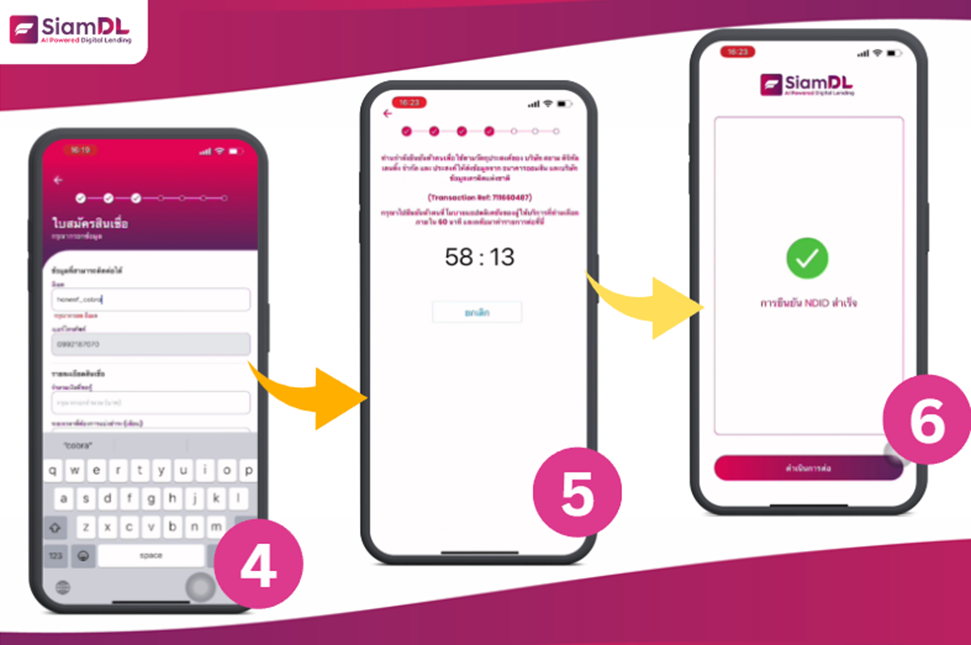

The next step will be the loan application form page, which includes:

- Contact Information

- Phone Number

- Loan Details

- Amount Requested for Loan

- Duration of Installment

- Repayment Date …

- Total Monthly Debt Including Home Loan Debt

- Bank to Receive Money

- Bank Account Number to Receive Money

- Account Holder Name

- Income Details

- Monthly Income

- Net Monthly Income

- Other Net Income

- Total Annual Income

- Employment Details

- Working Status

- Department

- Occupation

- Current Position

- Company Name

- Working Phone Number

- Working Province

- Total Work Experience

- Education Information

- Education Level

- Status Details

- Status

- Number of Children

- Spouse Title

- Spouse’s Full Name

- Spouse’s National Identification Number

- Spouse’s Date of Birth

- Spouse’s Phone Number

- Current Address

- Address

Residence Type- *** On the identity verification page, the application will state that “You are verifying your identity for the purposes of Siam Digital Lending Co., Ltd.” and will request information from the Government Savings Bank and the National Credit Bureau (Please verify your identity on the mobile banking app of the service provider you have chosen within 60 minutes and then return to continue the transaction).

- Address

-

-

-

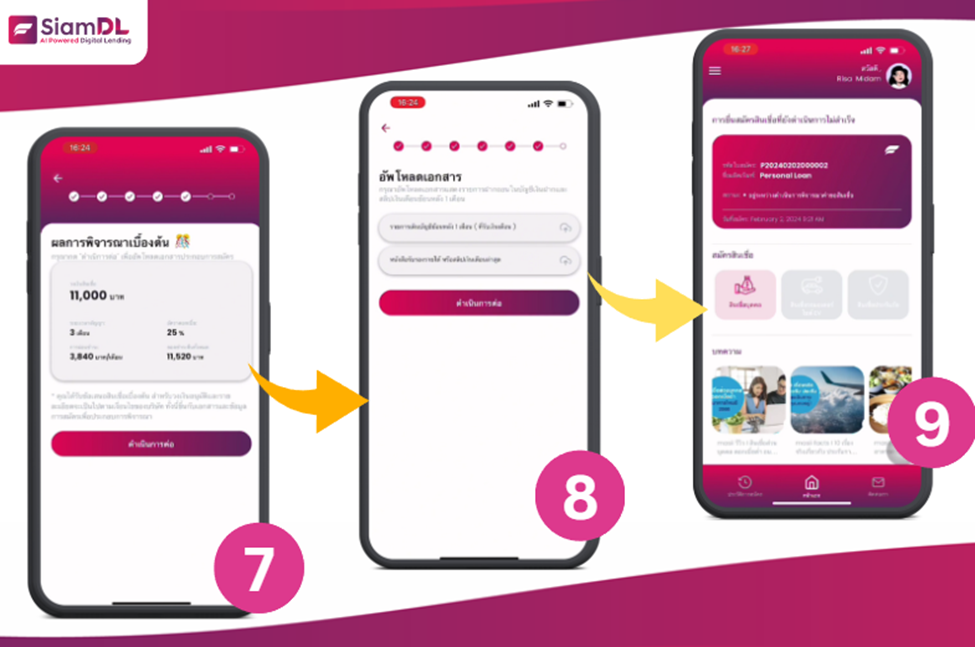

- 6. Once your identity has been verified, the application will display a preliminary result

-

-

-

- window

-

-

-

-

-

- Please click “Continue”.

-

-

7. Go to the document upload page which includes:

7. Go to the document upload page which includes:

- A statement of account for the past month

- A certificate of income or the latest pay slip

Then press “Continue”

8. The application will display a Loan Application window with the status “Your loan is in process”.

9. After that, enter the application submission process for consideration, wait for quick approval within 15 minutes, and enter the window to notify the approval result and loan details if approved.

Note:

- At this stage, please check the loan terms and interest rates before submitting the application. Read the details about the interest rates and repayment schedules for transparency and affordability.

- For the loan terms and approval, after filling in all the information, the app will show you the loan offers with the loan terms and interest rates that are legal in Thailand. Once you have reviewed and accepted them, you can submit your application immediately.

- Once approved, the money will be quickly transferred to your linked bank account so that you can get the money you need in a short time.

- In case the applicant is not approved for the loan, you can reapply in another 90 days.

- You should borrow only what you need and can repay.

Safety and reliability with legal loan app Siam Digital Lending

Siam Digital Lending Co., Ltd. is dedicated to protecting your financial choices and rigorously follows legal security standards and data management under Thailand’s Personal Data Protection Act B.E. 2562 (PDPA), as well as the identity verification procedure with National Digital ID Co., Ltd. Furthermore, credit checks with National Credit Bureau Co., Ltd. provide an extra degree of security and trustworthiness to the loan approval procedure, ensuring that the loan is fair and just.

FAQs

1. Who is eligible to apply for a loan on the Siam Digital Lending app?

Applicants must be Thai nationals aged 20 years or older, have a valid ID card, and have a regular income.

2. When will I receive my money after approval?

Our team will review your application and if it is complete, you will be approved within 15 minutes. The loan amount will be transferred to your bank account within 15 minutes after approval, which is the fastest time.

3. Are there any additional costs?

Siam Digital Lending is a legal loan app that operates transparently with no hidden fees. All fees are clearly displayed during the application process.

4. Can I apply for a loan if I have a low credit score?

Although we do a credit check, we consider other factors as well, so a low credit score doesn’t mean you’ll be rejected right away.

5. Why is identity verification important?

For security and compliance with the law, we require all applicants to verify their identity, which is a secure way to verify your information and is in line with NDID standards. We use your national ID card to verify your identity, so please allow the app to access your device’s camera to scan your national ID card, and after verifying your identity, you can apply for a loan immediately.

6. What happens if I miss a payment?

แอป SiamDL มีตัวเลือกการผ่อนชำระที่ยืดหยุ่น อย่างไรก็ตาม การชำระล่าช้าอาจมีค่าธรรมเนียมเพิ่มเติม จึงควรปฏิบัติตามกำหนดการชำระคืนเสมอ

7. ทำไมต้องเลือกใช้ สินเชื่อส่วนบุคคล SiamDL ?

When choosing a lender, consider the benefits and security that come with reliable service. This is why SiamDL personal loans are the best choice.

- Legal and Compliant Licensed and regulated by the Bank of Thailand

- Fast approval, taking about 15 minutes to approve

- Flexible repayment options with repayment periods ranging from 3 to 30 months

- Transparent interest rates Fair, transparent and legal interest rates in Thailand

- Legal loan apps are easy to use, convenient to use, downloadable on both Android and iOS

With these features, Siam DL is a solid choice for personal loans in Thailand.

Conclusion

With Siam Digital Lending, a legal loan app, accessing legal and reliable credit in Thailand is easier than ever. This user-centric platform allows you to apply for a loan securely

with fast approvals, flexible terms and legally fair interest rates.

Download the app and get started today!!!

Are you ready to apply for a legal personal loan with Siam Digital Lending? Just download the app from Google Play or App Store to experience the ease and convenience in every step of applying for a personal loan at SiamDL.

Download now!!!

- Android: https://play.google.com/store/apps/details?id=com.sdl.siamdigitallending

- Apple Store: https://apps.apple.com/th/app/siam-digital-lending/id6468746426?l=

Fulfill all your needs with a multipurpose personal loan without collateral from SiamDL.

No collateral or guarantor required. Credit approval up to 5 times your average monthly income or up to 200,000 baht. You can choose to pay in installments for up to 30 months.

- Instant cash loan, approval results within 15 minutes

- Personal loans provide full online services, such as applying, receiving money, checking balances, paying bills, payment schedules, etc.

- Legal loans, under the supervision of the Bank of Thailand

- Taking care of data security according to the Personal Data Protection Act.

- Transparent services, providing fair loans with a normal interest rate of 25%, ready to provide advice on debt problems

- Low income can apply, starting at 12,000 baht or more

Download and Apply for SiamDL Personal Loan for Android System

Download and Apply for SiamDL Personal Loan for iOS System

Contact us

- Address: 8th floor, Dr. Gerhard Link Building 5, Soi Krungthep Kreetha 7, Huamark, Bangkapi, Bangkok 10240

- Tel: 02 016 9300

- Office hours: 08:30 – 17:30

- Email: [email protected]

Find us online

- Line:@siamdlloan

- Facebook:Siamdl Finance

- IG:siamdlloan

- Youtube:siamdlloan

- Tiktok:siamdlloan

Read more interesting articles

#SiamDL #SiamDigitalLending #PersonalLoan #QuickLoan #LegalLoanApp #LoanApp #LowInterest #QuickApproval #LoanApp #Finance #OnlineLoan

*** Borrow only what you need and can afford / Maximum interest rate 25% per year

*** Siam Digital Lending Co., Ltd. is a socially responsible financial service provider. We offers personal loans SiamDL through the Siam Digital Lending app. It is licensed and governed by the Bank of Thailand.