In the modern era, Technology has come to play a huge role in everyday life. Whether it is a financial transaction or a request. Siam Digital Lending application (SiamDL personal loan provider) is one of the legal and highly reliable loan apps in Thailand. Not only do they provide quick and easy loans. However, there is also a convenient and transparent monitoring of the status of loan applications.

If you have I have applied for a personal loan through the SiamDL app and want to know how to check the status of your loan application. This article will provide a detailed guide along with an explanation of the interesting features of this legal loan app.

Get to know Siam Digital Lending, a legal loan app

Siam Digital Lending (SiamDL) is an application that provides fully digital personal loans by providing legal loans and is certified by the relevant authorities, namely the Bank of Thailand (BOT).

It also has an important feature is the use of AI technology to analyze the credit and financial behavior of applicants. This makes loan approval fast. In addition, there is a fair interest rate, the interest rate is in accordance with the law, and there is flexibility in repayment. This makes it possible for users to manage their finances more conveniently.

Using the Siam Digital Lending app is not only easy to apply for a loan, but it also has features that allow users to track the status of their applications 24/7. 24 hours via your smartphone. This is what makes Siam Digital Lending one of the most popular legit loan apps in 2024-2025.

Steps to check the status of personal loan application on the SiamDL app

Once you have applied for a SiamDL personal loan through the Siam Digital Lending app, checking the status of your application is an important and convenient step. In case you want to know the results or statuses, you can easily do as follows:

-

Open the Siam Digital Lending app on your smartphone.

After you have downloaded and installed the Siam Digital Lending app on your smartphone, open the app and log in with the username and password you have registered. If you haven’t signed up yet, you can find out how to register and verify your identity to access the application. Here! You must register first to use the app.)

-

Enter the “Loan Application Status” page.

You can choose to go to the “Application Status” or “My Loan” menu to see information about your personal loan application.

-

Check the status of your loan application

On this page, you will see the details of the loan application you have made, which will contain the following information:

- Application Status: Reviewing, Approval, Pending Confirmation, or Rejected

- Loan Application Number

- Application Date: The date you submitted your loan request.

- Credit Limit: The amount of money you are applying for a loan.

- Interest and repayment terms: More information about the interest payable and how to repay it

-

SMS Notifications

In case your loan application is approved or rejected, you will receive a notification via SMS as you have registered with the Siam Digital Lending app.

-

Contact Customer Service

If you encounter any problems or queries regarding the status of your loan application, you can contact Siam Digital Lending’s customer service directly via Call Center 02 016 9300 or LINE ID: @siamdlloan.

Advantages of applying for a loan through Legal Loan App SiamDL

Using the Siam Digital Lending app service in addition to providing convenience in applying for loans, there are many other advantages that make this app a good choice for those who want to borrow money through a legal loan app:

-

Legal and safe loans

One of the main concerns of those who want to apply. Online loans are safety and reliability. The Siam Digital Lending app is a legit loan app certified by the relevant authorities. This ensures that users can be assured that applying for personal loans through this app is safe and transparent.

-

Fast application and approval

The loan application and approval system of the Siam Digital Lending app is designed to provide users with approval in a short time. Using AI technology to analyze the applicant’s credit and financial information. This makes the whole process efficient.

-

Fair and transparent interest rates

By applying for a SiamDL personal loan through a legal loan app such as the Siam Digital Lending application, you will receive clear information about the interest rate and repayment terms. As required by law. Our app emphasizes transparency in interest calculation and does not hide additional costs. This allows you to plan your finances carefully.

-

Flexible repayment options

In addition to applying for loans quickly and easily. The Siam Digital Lending app also offers flexible repayment options from 3 months to 30 months, which users can choose to repay according to their convenience. ( How to repay SiamDL personal loan can be found here!)

-

24-hour tracking of application status

Another advantage of using the Siam Digital Lending app is that users can track the status of their applications 24 hours a day through their smartphones. You don’t have to wait for a response from the staff like you would if you applied for a traditional loan (you can download the Siam Digital Lending application. Today -> download in iOS , -> download in Android )

Precautions for applying for SiamDL personal loan through the legal loan app Siam Digital Lending

Although legal loan apps like Siam Digital Lending are safe and reliable, there are some precautions that you should be aware of when applying for a SiamDL personal loan.

-

Don’t ask for more loans than necessary.

Before applying for a loan, it’s important to consider whether you need to take out the loan in an amount that you can repay. Do not take out more than you can afford, as this may result in you having to pay higher interest in the future.

-

Read the repayment terms carefully.

Before confirming the loan application, it is important to read and understand the repayment terms carefully, such as the amount to be paid, interest, and payment date.

-

Beware of providing personal information

While legitimate loan apps have high security measures, be careful about providing personal information such as bank account numbers or passwords.

summarize

work SiamDL personal loan application through the Siam Digital Lending application is a convenient and safe way for those who want to access personal loans. Here!) This ensures the safety and transparency of the service.

If you have already applied for a loan through this app and want to check the status of your application. You can easily do it through your smartphone, following the steps we have guided. Using a legal loan app like SiamDL will help you access fast and safe loans while also managing your finances effectively.

Download the app and get started today!!

Just download the app from Google Play or App Store to experience the ease and convenience of every step of applying for a SiamDL personal loan.

Download Now!!

- Android: https://play.google.com/store/apps/details?id=com.sdl.siamdigitallending

- Apple Store: https://apps.apple.com/th/app/siam-digital-lending/id6468746426?l=

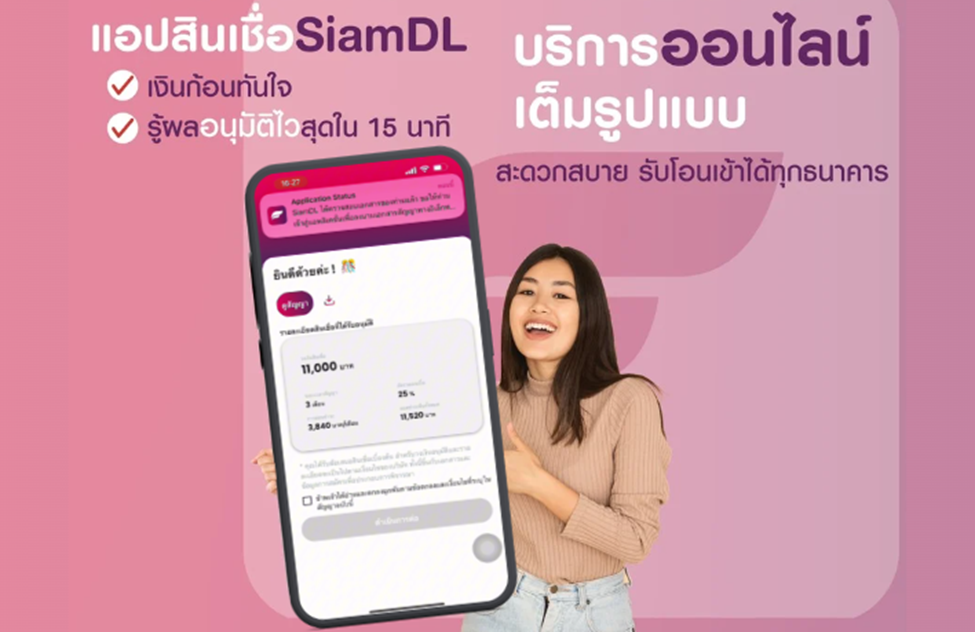

Fulfill all your needs with SiamDL Multi-Purpose Non-Guaranteed Personal Loan

The approval limit is up to 5 times the average monthly income or up to 200,000 baht, and installments can be selected for up to 30 months.

- Instant quick loans, get approval results as soon as possible within 15 minutes.

- Personal loans are available through a full online system, such as applying, receiving money, checking balance, and paying bills. Installment schedule, etc.

- Legal loans Under the supervision of the Bank of Thailand and overseeing data security in accordance with the Personal Data Protection Act.

- Transparent services, fair loans with a normal interest rate of 25% and consultation on debt burden issues.

- Low-income people can apply. Starting from 12,000 Baht

Apply for SiamDL personal loan Android system

Apply for SiamDL personal loan iOS system

Contact Us

Siam Digital Lending Co., Ltd. is a financial service provider with personalized loan products that are tailored and aligned with the needs of its customers. It also makes it easier for customers to access legal loans, which is in line with the Bank of Thailand’s mission to help solve the problem of informal borrowing and high household debt ratios.

We are committed to developing and improving our ability to serve our clients, as well as to provide the best financial experience for all our clients. If you have questions, inquire Report problems or complaints You can send us a message right away. We will get back to you as soon as possible.

- Address: 8th Floor, Dr. Gehard Link 5 Building, Soi Bangkok Kreetha 7, Hua Mak, Bangkapi, Bangkok 10240

- Tel.: 02 016 9300

- Opening Hours: 08:30 – 17:30

- Email: [email protected]

Find us online

- Line: @siamdlloan

- Facebook: Siamdl Finance

- IG: siamdlloan

- Youtube: siamdlloan

- Tiktok: siamdlloan

Read more interesting articles

- Open how to apply for SiamDL personal loanLegal loan app Easy to apply, quick approval within 15 minutes!

- masii Review I answers all your questions with personal loans for the new generation!

- Reveal how to calculate the interest rate on loans per year How do you think?

- Introduction to Siam Digital Lending Online Personal Loans and How to Repay

- KTAM Promotes 4 Tax-Saving Funds and Recommends DCA to Reduce Volatility … Here!)

#SiamDL #SiamDigitalLending #PersonalLoan #QuickLoan #LegalLoanApp #LoanApp #LowInterest #QuickApproval #LoanApp #HowToRepay #SiamDL #Finance #OnlineLoan