In today’s fast-paced world, many turn to urgent loan and online borrowing to quickly meet financial needs. Debt has become commonplace, whether it’s through personal loans to pay for a house, a car, or emergencies. However, taking on excessive debt can lead to significant challenges, including financial strain, mental health issues, and familial disputes.

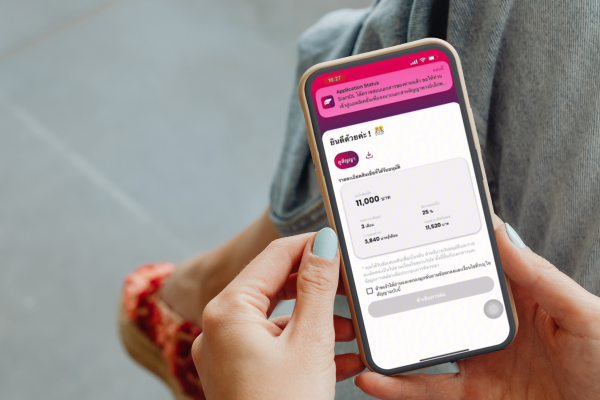

Siam Digital Lending recognizes the importance of responsible debt management. Through its app, it provides safe, legal, and swift loan options. You can easily secure an urgent loan without the hassle of paperwork and receive approval within just 15 minutes.

What Is Overburdening Debt from Urgent Loan ?

Overburdening debt refers to a financial state where your repayment obligations exceed your capacity to repay. This could involve dedicating over 50–60% of your monthly income to paying off debt, leaving insufficient funds for essential expenses or forcing you to borrow more to cover existing debts.

Using appropriate personal loan products is one way to prevent excessive debt. Opting for legal and transparent services, such as Siam Digital Lending, can help you manage your finances effectively. Their loan products are designed to offer stability and flexibility to borrowers.

Consequences of Excessive Debt

- Financial Strain

High levels of debt can tighten cash flow, leaving little room for necessary expenses like utility bills, medical emergencies, or daily necessities. Opting for a personal loan with favorable terms, like those offered by Siam Digital Lending, can reduce financial pressure with competitive interest rates and manageable payment plans. - Stress and Mental Health Issues

Excessive debt often leads to worry and anxiety, adversely impacting mental well-being. Choosing a legal and reliable service for online borrowing, such as Siam Digital Lending, can help you avoid predatory interest rates and unclear terms, alleviating unnecessary stress. - Strained Family Relationships

Debt can often result in family conflicts. By opting for safe loan solutions, you can take charge of your financial situation, paving the way for healthier relationships and a more secure financial future. - Increased Risk of Resorting to Illegal Lending

Turning to informal lenders with exorbitant interest rates and aggressive collection practices can exacerbate your problems. Selecting a regulated and transparent online loan service like Siam Digital Lending ensures you get the financial support you need without additional risks.

How to Avoid Overburdening Debt

- Plan Your Finances Carefully

Before applying for a personal loan, evaluate your repayment capacity. Choose trusted lenders like Siam Digital Lending, which offers straightforward and fair online loan solutions tailored for modern borrowers. - Spend Wisely

Many debts arise from unnecessary spending, such as splurging on luxuries or misusing credit cards. Opt for loans with reasonable limits to maintain control over your expenditures. - Choose Safe Loan Providers

Always borrow from verified and certified providers. For example, Siam Digital Lending is recognized as a safe and transparent choice, offering quick and reliable services through its app. - Cultivate Financial Discipline

Maintaining a detailed income and expense log and setting savings goals are crucial to avoiding excessive spending. This proactive approach can help reduce your reliance on borrowing in the future.

Solutions for Managing Excessive Debt

- Negotiate with Creditors

If you’re struggling to repay your loans, consider negotiating with creditors to restructure your debt or refinance with a lower-interest personal loan, like those offered by Siam Digital Lending. - Seek Financial Advice

Consulting financial experts can provide tailored solutions for managing debt, including suitable loan products to ease financial burdens. - Opt for Legal and Regulated Urgent Loan

If an urgent financial need arises, using a legal online borrowing service like Siam Digital Lending ensures safety and reliability, allowing you to address your financial challenges responsibly.

Why Choose Siam Digital Lending?

Managing debt responsibly is essential in today’s world, where many rely on urgent loan and online borrowing to meet immediate financial demands. Excessive debt, however, can lead to long-term challenges, including financial instability, mental health strain, and familial discord.

Choosing legal and secure loan providers, such as Siam Digital Lending, reduces risks and enhances financial management. This service is designed for modern borrowers, offering fast, efficient, and transparent lending solutions through its app, with loan approvals in just 15 minutes.

Core Principles for Preventing Excessive Debt

- Careful Financial Planning

- Choosing Safe and Reliable Loan Providers

- Fostering Financial Discipline

If you’re facing debt challenges, consider negotiating with creditors or using services from legal lenders to avoid long-term consequences. This ensures financial stability and helps you maintain peace of mind.

Siam Digital Lending is committed to helping clients manage their finances safely and confidently. Their urgent loan and online borrowing services cater to the needs of a fast-paced, transparent, and efficient financial world.

Download the App and Start Today!

Ready to apply for a legal personal loan with Siam Digital Lending? Download the app from Google Play or the App Store to experience the convenience and simplicity of personal loan applications through SiamDL.

Flexible Loan Options

- No Collateral or Guarantor Required

- Loan amounts up to 5 times your average monthly income or a maximum of THB 200,000.

- Flexible repayment plans of up to 30 months.

Key Features:

- Instant Loan Approvals: Know the results within 15 minutes.

- Fully Online Service: From application to repayment.

- Legal and Transparent: Regulated by the Bank of Thailand, with data security protected under privacy laws.

- Fair Interest Rates: Standard interest rate of 25%, offering debt consultations when needed.

- Low Income-Friendly: Applicants earning as little as THB 12,000 monthly are eligible.

Apply for SiamDL Personal Loans:

Contact Us

Siam Digital Lending Co., Ltd. is dedicated to providing financial services tailored to customers’ needs, ensuring access to legal and transparent loans. This aligns with the Bank of Thailand’s mission to combat illegal borrowing and household debt issues.

If you have any questions, inquiries, or complaints, reach out to us:

- Address: 8th Floor, Dr. Gerhard Link Building, 5 Bangkok Kritha 7 Alley, Huamark, Bangkapi, Bangkok 10240

- Phone: 02 016 9300

- Hours: 08:30 – 17:30

- Email: [email protected]

Follow Us Online

- Line: @siamdlloan

- Facebook: Siamdl Finance

- Instagram: siamdlloan

- YouTube: siamdlloan

- TikTok: siamdlloan

This extensive overview provides actionable insights and solutions for managing debt and making informed financial decisions. Whether you’re looking for urgent financial help or a structured loan option, Siam Digital Lending is here to assist!