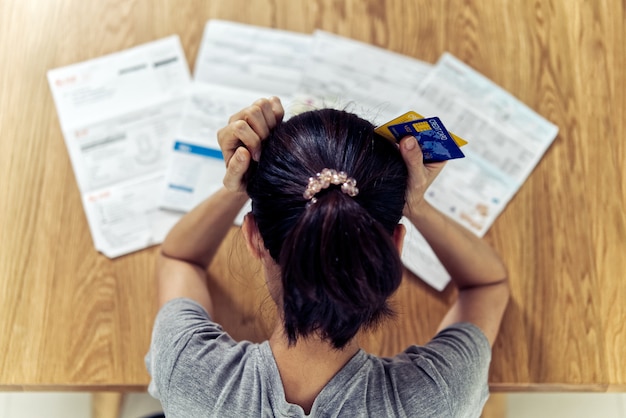

Salarymen who are stuck in a cycle of living paycheck to paycheck or borrowing money from their future to use frequently until they have no savings, don’t worry because Masii has compiled 10 steps to financial planning that, starting today, will help you clear all your financial problems, help you save money and have money to use until you retire. Let’s go see this interesting thing … (Ready for you to apply for a legal personal loan and compare personal loans before anyone else!! )

10 steps to financial planning. Start today and have money to use until retirement.

What is financial planning and why is it important?

Financial planning is the planning and management of our current assets and debts in order to accumulate wealth leading to the achievement of our financial goals, whether it be short-term goals such as paying off small debts, saving money to buy appliances, or long-term goals such as paying off a house and saving for retirement, etc.

Advantages of financial planning

1. Have clear financial goals and know your financial status.

2. Know your debt status, so you don’t create debt beyond your means

. 3. Have enough money to spend when you retire.

4. Manage risks, making your life stable.

5. Know how to invest money, creating wealth.

( Click here to compare personal loans or apply for a personal loan. Get a lump sum before anyone else. Quick approval. 100% legal. )

Financial planning steps for salaried employees

Financial planning steps for salaried employees

1. Set clear financial goals.

Setting clear financial goals is the motivation to save money, such as wanting to have 100,000 baht in a year. When you have these goals, you can plan how much you should save each month or how much more money you need to earn to achieve your goals.

2. Make a regular income and expense account.

Many people are afraid if they see the number of expenses that are more than the income. But that is the advantage for those who start to plan their finances because at least they will know what they spend on each day and have to start being more careful about spending money. As for keeping an account of income and expenses, it can be easily done through an application on a mobile phone or can be made into a table in Excel.

3. Make a financial plan before spending.

When you have an overview of your income and expenses, plan your finances before spending. For example, on the first day of payday, set aside money for monthly expenses and other expenses. This will help you know how much money you have available to spend, prevent you from spending more than your budget, and help you save money better.

4. Reduce debt creation and unnecessary expenses.

For those who like to shop, eat, and relax and reward themselves regularly, to reduce expenses in this area, you should follow the financial plan that was set out from the beginning. This will allow you to know how much money you have to spend in this area. For example, you may be able to eat a buffet or buy a large item for yourself once a month. Before making a decision, you should think carefully to reduce the creation of new debts that will occur.

5. Clear all debts.

In addition to having clear income and expenses, before salaried workers plan to save money, it is very important to clearly show all debts in order to plan monthly debt payments. For debts that can be paid in installments, they should not be left unpaid until they have to find a lump sum to pay off, because this may cause trouble later.

( Click here to compare personal loans or apply for a personal loan. Get a lump sum before anyone else. Quick approval. 100% legal. )

6. Manage risk by purchasing insurance.

Most salaried employees have social security and company medical benefits, but they may not be sufficient or comprehensive. Having health insurance or life insurance is considered a risk management, helps save expenses, and gives peace of mind that you will receive the best treatment.

7. Plan your taxes in advance from the beginning of the year.

Financial planning with tax planning in advance from the beginning of the year is important. In addition to using the full deduction rights, you will have a comprehensive financial plan, including savings, investment, and tax plans. You can also use the money from tax deductions to save.

8. Choose a savings method that suits you.

There are many ways to save money, but you have to choose a savings method that suits you, such as saving 10% of your salary. If you earn 15,000 baht, that’s equivalent to saving 1,500 baht. Or another way is to make a fixed deposit of the same amount every month for 2-3 years according to the bank’s conditions, along with getting interest as a bonus. Krungthai Bank itself has 2 interesting savings account services: Krungthai ZERO TAX MAX and Krungthai NEXT Savings, which will help you be disciplined and save more money than before.

9. Always seek financial knowledge and develop yourself.

When you set financial goals and plan your finances seriously, it is very important to constantly seek financial knowledge and develop yourself. In addition to looking for new ways to save money that fit your lifestyle, it also allows you to see other investment channels that can create wealth for yourself.

10. Invest further to make your money grow.

Another interesting way for salaried workers to save enough money after retirement is to invest to grow their money, such as investing in low-risk mutual funds.

For those who are interested in starting to invest in mutual funds, they can invest in mutual funds, whether it is a long-term equity fund (LTF) or a retirement mutual fund (RMF). They should find information and study each investment carefully. It is convenient and safe.

Serious financial planning will not only provide enough money after retirement, but will also create stability and wealth for life.

( Click here to compare personal loans or apply for a personal loan. Get a lump sum before anyone else. Quick approval. 100% legal. )

In the midst of a global economic downturn, we’re introducing!!! Siam Digital Lending, a legal loan app. Accessing legal and reliable credit in Thailand is now easier than ever. This user-centric platform allows you to securely apply for a loan with fast approvals, flexible terms, and legally fair interest rates.

Download the app and start a new bright financial future today!!!

Are you ready to apply for a legal personal loan with Siam Digital Lending ? Just download the app from Google Play or App Store to experience the ease and convenience in every step of applying for a personal loan at SiamDL.

Download now !!!

- Android: https://play.google.com/store/apps/details?id=com.sdl.siamdigitallending

- Apple Store: https://apps.apple.com/th/app/siam-digital-lending/id6468746426?l=

Fulfill all your needs with a multipurpose personal loan without collateral from SiamDL.

No collateral or guarantor required. Credit approval up to 5 times your average monthly income or up to 200,000 baht. You can choose to pay in installments for up to 30 months.

- Instant cash loan, approval results within 15 minutes.

- Personal loans are provided through a full online system, such as applying, receiving money, checking balances, paying bills, payment schedules, etc.

- Legal loans under the supervision of the Bank of Thailand and data security under the Personal Data Protection Act.

- Transparent service, fair loans with normal interest rate of 25%, and debt burden problem consultation.

- Low income can apply, starting at 12,000 baht or more.

Apply for SiamDL personal loan Android system

Apply for SiamDL personal loan iOS system

Contact us

Siam Digital Lending Co., Ltd. is a financial service provider with personal loan products that are suitable and in line with customer needs. It also helps customers access legal loans more easily, which is in line with the Bank of Thailand’s mission to help solve the problem of borrowing money from informal sources and high household debt ratios.

We are committed to developing and improving our ability to serve our customers and provide the best possible financial experience to all customers. If you have any questions, inquiries, concerns or complaints, please feel free to send us a message and we will get back to you as soon as possible.

- Address : 8th floor, Dr. Gerhard Link Building 5, Soi Krungthep Kreetha 7, Huamark, Bangkapi, Bangkok 10240

- Tel: 02 016 9300

- Business hours: 08:30 – 17:30

- Email: [email protected]

Find us online

- Line: @siamdlloan

- Facebook: Siamdl Finance

- IG: siamdlloan

- Youtube: siamdlloan

- Tiktok: siamdlloan

=

Read more interesting articles

- Introducing Siam Digital Lending Online Personal Loans and Repayment Methods Open How to Apply for SiamDL Personal Loans Legal Loan App Easy to Apply, Quick Approval within 15 Minutes!

- masii Review I Answer all questions about personal loans for the new generation! “SiamDL Personal Loan”

- Revealing the method of calculating interest rates on loans per year, per month or per day. How is it calculated?

- Good days, auspicious days, August 2024, updated here…with unlucky days, avoid bad days if possible.

- KTAM promotes 4 tax-saving funds and recommends using DCA to reduce volatility… Is it a good idea to borrow personal loans to invest? (Answers here!)

#SiamDL #SiamDigitalLending #PersonalLoan #QuickLoan #LegalLoanApp #LoanApp #LowInterest #QuickApproval #LoanApp #HowToRepay #SiamDL #Finance #OnlineLoan